-

AIX Exchange携手币安生态矩阵,揭幕“Web3版纳斯达克”

发布时间:2025/10/23

10月24日20:00,全球知名区块链媒体非小号(Feixiaohao.ai)、TalkingWeb3将携手AIXExchange和全球百大KOL举办华语区线上首秀特别直播,正式揭开“Web3版纳斯达克”的序幕。本次活动将在X、币安广场、币安Live、火...

-

撒钱十个亿,只做真公益!振东制药诠释现代公益新范式

发布时间:2025/06/11

如果说慈善事业是企业责任感的一个缩影。那么振东制药的慈善“侧写”便是大爱无疆。山西振东健康产业集团自太行山深处诞生,稳扎稳打、守正创新,跻身中国药企中流砥柱行列。引导旗下公益扶贫办凝聚共识、加强合作...

-

创客匠人联合主办第二届中国心理学应用发展大会,深耕“AI+心理学”应用

发布时间:2025/05/30

导语: 2025年5月24日,第二届中国心理学应用发展大会在杭州水博园盛大开幕。作为联合主办方,创客匠人通过“AI+心理学应用”圆桌论坛和“心理人的破局发展”工作坊两大核心活动,为3000余名参会者带来前沿的数字化解决方...

-

纳斯达克‖飞兔商联启航全产业链聚合生态重构行业格局

发布时间:2025/05/27

在互联网行业爆发式增长的浪潮中,贵州飞兔商联云信息技术有限公司(以下简称“飞兔商联”)以“科技+线上+线下”三位一体的合伙人创新模式,成为资本市场瞩目的焦点。作为中国互联网全产业链聚合生态的构建者,公司...

-

浑水协助Wolfpack做空爱奇艺(IQ.US) 看空报告全文来了

发布时间:2020/04/08

本文来源“腾讯网”。 划重点:1.两家中国广告公司向我们提供了爱奇艺(IQ.US)后端系统的数据,这些数据显示,从2019年9月开始,爱奇艺的实际移动DAU比该公司在2019年10月宣称的1.75亿平均移动DAU低了60.3%。2.大约3...

-

华尔街大佬巴鲁克:特斯拉(TSLA.US)目标股价达600美元,仍有18%上行空间

发布时间:2020/04/08

本文来自“腾讯证券”。 在券商杰富瑞(Jefferies)将特斯拉评级从“持有”上调到“买入”后,特斯拉(TSLA.US)在周一收盘上涨逾7.5%。上周五,特斯拉也因公司第一季度业绩强劲而迎来上涨。数据显示,该公司第一季度共...

-

不满足于流媒体业务,亚马逊也要开始做游戏了

发布时间:2020/04/08

本文来源“36氪”。为了在统治数字娱乐的战役中开辟新战线,Amazon(AMZN.US)正在投入数亿美元以成为视频游戏的领先制作商和发行商。由于卫生事件的影响数度推迟之后,这家互联网巨头表示,打算在5月发布其首款原创...

-

刘强东“熔断”,徐雷成为京东的新“保险丝”

发布时间:2020/04/08

本文来自“盒饭财经”。公共卫生事件笼罩世界,全球经济遭遇重创,金融市场难以幸免,“熔断”一词频繁走入人们视野中。 作为在美股上市的企业,京东(JD.US)最近的日子也不太好过。瑞幸造假事件曝出后,京东“二号人...

ChainSafeAI Participates in the Hong Kong Crypto Asset Risk Management Seminar

发布时间:2026/02/09 区块链 浏览次数:15

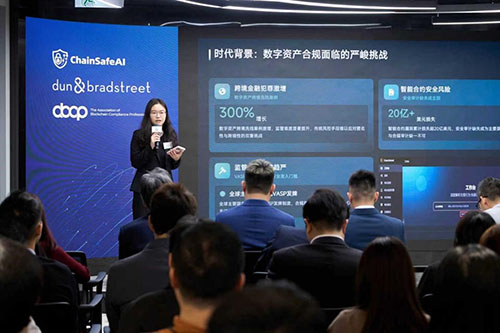

As the virtual asset market evolves at a rapid pace, traditional risk control approaches are increasingly inadequate to address the anonymity, cross-border nature, and high-frequency circulation of on-chain transactions. On February 5, 2026, the seminar “Turning Risk into Opportunity: Leveraging KYT to Optimize Crypto Asset Customer Risk Management”, jointly organized by Dun & Bradstreet (D&B) and ABCP and sponsored by ChainSafeAI, was held in Hong Kong. The event brought together professionals from regulatory bodies, law enforcement agencies, financial institutions, and technology companies to explore how KYT (Know Your Transaction) can enable a paradigm shift from passive compliance to proactive risk management.

I. Cross-Sector Dialogue: Building a New Ecosystem of Collaborative Governance

The seminar highlighted Hong Kong’s proactive stance and collaborative governance philosophy in the regulation of virtual assets. Hosted by Raymond Chai of D&B, the event featured keynote speakers representing diverse perspectives.

From a regulatory and law enforcement perspective, Bonnie Ngan, Chief Inspector of the Hong Kong Police Force, shared real-world cases and challenges in combating cryptocurrency-related crimes.

From an industry practice perspective, Jack Keung, Head of Compliance at a Hong Kong digital asset trading platform and former Compliance Manager at HashKey, discussed practical experience in balancing innovation and compliance in daily exchange operations.

From a technology solutions perspective, Lawson Luo, Partner at ChainSafeAI, provided a systematic analysis of how KYT overcomes the limitations of traditional KYC and delivers practical, deployable risk management tools for institutions.

The diverse attendee profile reflected deep cross-departmental collaboration, including representatives from the Securities and Futures Commission (SFC), the Hong Kong Monetary Authority (HKMA), and the Financial Services and the Treasury Bureau (FSTB), as well as officers from the Police, Customs, and the Independent Commission Against Corruption (ICAC). Compliance leaders from financial institutions such as Industrial Bank, Airstar Bank, Morgan Stanley, and Futu Securities were also present, jointly exploring pathways for the compliant and sustainable development of crypto asset businesses across different institutional contexts.

II. From KYC to KYT: A Fundamental Evolution in Risk Control Models

During the seminar, Estelle, Compliance Manager of ChainSafeAI’s Product and Compliance Department, emphasized that KYC alone is no longer sufficient to address dynamic on-chain risks. If KYC is likened to a static photograph, KYT is more like a live broadcast, continuously tracking fund flows and behavioral patterns to enable real-time risk identification and assessment.

This view was echoed by regulators. A representative from the Securities and Futures Commission noted that complex crimes such as cross-border money laundering using cryptocurrencies are on the rise, making real-time transaction monitoring capabilities an inevitable requirement for the industry.

Beyond showcasing KYT solutions, Estelle explained how ChainSafeAI leverages data and artificial intelligence to transform massive and fragmented on-chain transaction data into clear, actionable risk intelligence. The solution is built on three core technological pillars.

First, visualized risk identification. Through high-concurrency APIs, the system detects transactions at the millisecond level and performs real-time comparisons against continuously updated databases of risky addresses, including hacker wallets, mixers, and sanctioned entities, issuing timely alerts for high-risk interactions.

Second, on-chain address risk scoring. By deeply analyzing fund flows, address linkages, and behavioral patterns, the system generates dynamic risk scores for each address, enabling quantitative and tiered risk assessment.

Third, intelligent alerts and automated responses. Based on predefined rules and machine learning models, the system automatically generates risk alerts and integrates with existing institutional workflows, triggering predefined control measures such as transaction suspension or enhanced due diligence to improve response efficiency.

III. Addressing Core Challenges: Diverse Application Scenarios of KYT

In response to widely shared industry concerns, the seminar explored the practical value of KYT in depth. In the context of anti-money laundering and counter-terrorist financing, KYT can effectively identify suspicious patterns such as distributed fund collection followed by aggregation and transfer, significantly enhancing monitoring accuracy.

For customer risk tiering, dynamic scoring models based on continuous transaction behavior analysis enable financial institutions to apply enhanced monitoring to high-risk clients while reducing unnecessary intervention for low-risk clients, thereby optimizing the allocation of compliance resources.

In addition, Estelle systematically addressed challenges such as the complexity and inherent risk exposure of DeFi interactions and the difficulty banks face in verifying the on-chain source of funds. Through customized solutions, investment funds can monitor real-time risks associated with portfolio interactions with DeFi protocols, while banks can conduct on-chain tracing for incoming funds, supported by visualized fund flow paths and risk assessment reports. This effectively answers the critical question of whether funds originating from the blockchain can be considered clean.

IV. The Future of Intelligent, Integrated, and Compliant Technology

Looking ahead, KYT technology is expected to deeply integrate with regulatory technology and supervisory technology, evolving toward greater intelligence and standardization. Artificial intelligence will be used to automatically interpret regulatory changes across multiple jurisdictions and dynamically adjust monitoring rules and models. At the same time, privacy-preserving computing technologies such as zero-knowledge proofs are being explored to better balance effective compliance verification with user privacy protection and data security.

This seminar marks a new phase in the evolution of virtual asset risk management, one that is more refined and proactive. Compliance technology providers such as ChainSafeAI are helping regulators gain real-time on-chain visibility while enabling financial institutions to strengthen their risk control frameworks as they embrace innovation. As Hong Kong’s virtual asset regulatory framework continues to mature, the co-evolution of technology and regulation will provide critical support for building a safer and more transparent digital financial ecosystem.

Contact Us

Tel: +852 6882 4033

Website: www.chainsafeai.com

Address: Room 63, 7/F, Wonder Commercial Building, 7–9 Austin Avenue, Tsim Sha Tsui, Kowloon, Hong Kong